34+ can mortgage interest be deducted

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and.

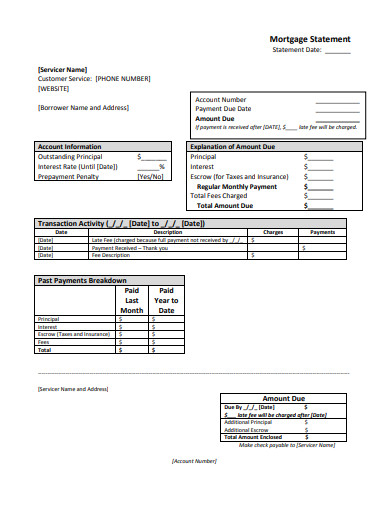

Mortgage Statement 10 Examples Format Pdf Examples

Homeowners who bought houses before.

. Web The mortgage interest deduction is a tax deduction you can take for mortgage interest paid on the first 1 million of mortgage debt during that tax year. Web Also you can deduct the points you pay to get the new loan over the life of the loan assuming all of the new loan balance qualifies as acquisition. Web How much you can deduct will depend on when you purchased your home.

Complete Edit or Print Tax Forms Instantly. Web Home Help Interactive Tax Assistant Can I Deduct My Mortgage-Related Expenses. Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction.

Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. For married taxpayers filing a separate return.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total. The loan may be a mortgage to buy your home.

Web The tax obligation reduction additionally applies if you pay interest on a condo cooperative mobile house watercraft or mobile home utilized as a house can. Ad Access Tax Forms. You may be able to deduct 100 of your mortgage interest paid in the previous year or.

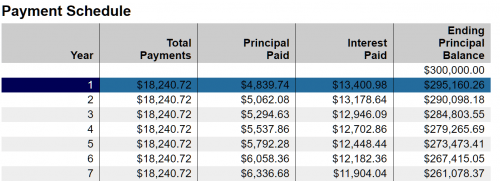

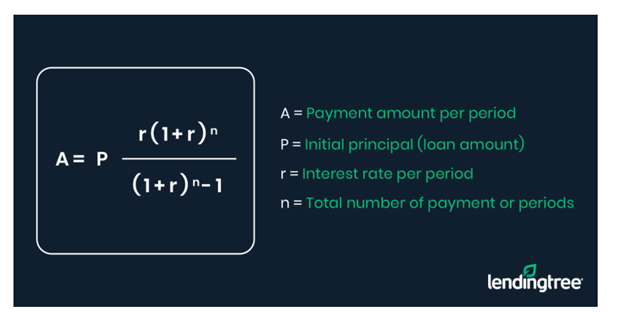

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Generally home mortgage interest is any interest you pay on a loan secured by your home main home or a second home. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as much.

States that assess an. ITA Home This interview will help you determine if youre able to deduct. Register and Subscribe Now to Work on Pub 936 More Fillable Forms.

Web The mortgage interest tax deduction is a tax benefit available to homeowners who itemize their federal income tax deductions.

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

What Is Pmi Understanding Private Mortgage Insurance And Removing It

Mortgage Interest Deduction Save When Filing Your Taxes

Mortgage Statement 10 Examples Format Pdf Examples

What Is Mortgage Interest Deduction Zillow

Mortgage Interest Deduction Save When Filing Your Taxes

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Bankrate

The Home Mortgage Interest Deduction Lendingtree

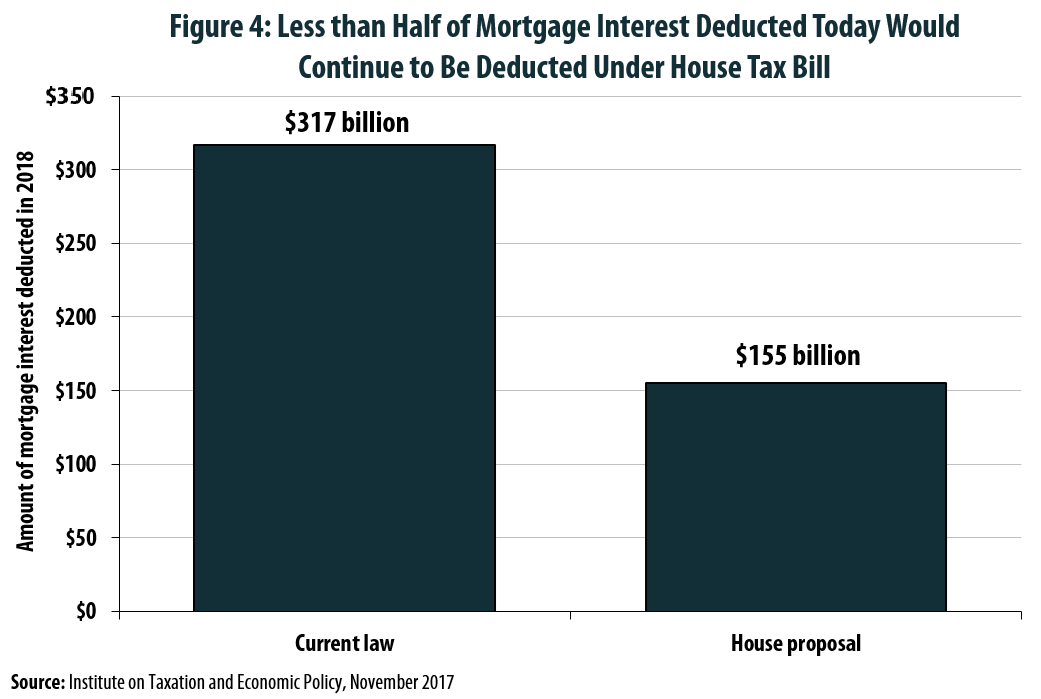

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Calculating The Home Mortgage Interest Deduction Hmid

Can I Deduct Mortgage Interest

Mortgage Interest Deduction Bankrate

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Mortgage Interest Deduction A 2022 Guide Credible

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

34 Free Editable Monthly Budget Templates In Ms Word Doc Pdffiller